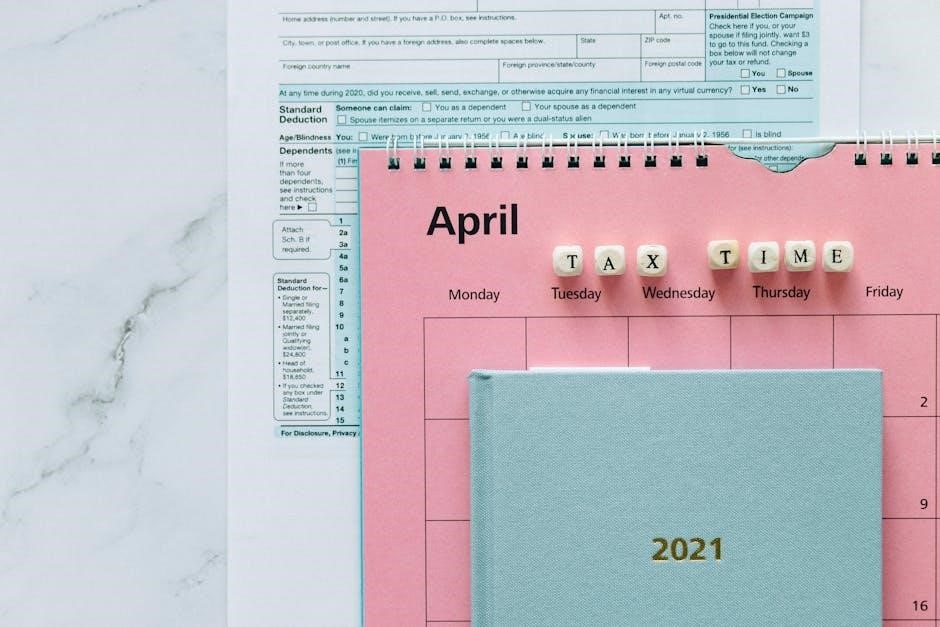

Form 990 Instructions Schedule L: A Comprehensive Overview (Updated 12/22/2025)

Schedule L (Form 990) details financial arrangements with “interested persons,” requiring nonprofits to disclose transactions and maintain transparency with the IRS.

What is Schedule L (Form 990)?

Schedule L (Form 990), officially titled “Transactions With Interested Persons,” is a crucial component of the annual information return that exempt organizations, filing either Form 990 or Form 990-EZ, may be required to complete. It serves as a dedicated space for reporting specific financial interactions between the organization and individuals or entities considered “interested persons.” These interactions extend beyond simple donations and encompass loans, compensation, reimbursements, and other financial arrangements.

The schedule’s primary function is to ensure transparency and accountability within the nonprofit sector. By meticulously detailing these transactions, Schedule L helps the IRS and the public scrutinize potential conflicts of interest and ensure that organizational resources are utilized appropriately. It’s a key tool in upholding the public trust and maintaining the integrity of tax-exempt organizations. Accessing the latest version and associated instructions is available at www.irs.gov/Form990.

Purpose of Schedule L

The core purpose of Schedule L (Form 990) is to identify and disclose financial transactions that could potentially create conflicts of interest or raise concerns about the appropriate use of an organization’s assets. It aims to ensure that no individual or entity unduly benefits from their connection to the nonprofit. This includes reporting arrangements with disqualified persons under section 4958.

Specifically, the schedule helps the IRS monitor compliance with regulations regarding excess benefit transactions and prevents private inurement – where an organization’s net earnings benefit private individuals. By requiring detailed reporting, Schedule L promotes transparency and accountability, fostering public trust in the nonprofit sector. It allows for scrutiny of financial dealings and helps safeguard the organization’s tax-exempt status. Detailed instructions are available on the IRS website at www.irs.gov/Form990.

Who Must File Schedule L?

Generally, organizations filing Form 990 or Form 990-EZ are required to complete Schedule L if they have engaged in certain transactions with “interested persons” during the tax year. This includes most tax-exempt organizations, such as charities, foundations, and other nonprofit entities. However, not all organizations will necessarily need to file it.

Specifically, if an organization has loans to or from interested persons, other financial transactions (like sales of property or services), or transfers to these individuals exceeding certain thresholds, Schedule L must be filed. The requirement hinges on the nature and value of these transactions. Referencing the latest instructions from the IRS, available at www.irs.gov/Form990, is crucial to determine specific filing obligations. Organizations should carefully review their financial activities to ensure compliance.

Relationship to Form 990 and 990-EZ

Schedule L (Form 990) is a supplemental schedule to the annual information return, Form 990, Return of Organization Exempt From Income Tax, or the shorter Form 990-EZ. It isn’t a standalone filing; it must be submitted alongside either Form 990 or Form 990-EZ when applicable. The primary Form 990 gathers comprehensive organizational data, while Schedule L focuses specifically on transactions with individuals or entities considered “interested persons.”

Information reported on Schedule L directly impacts the overall financial picture presented on Form 990. The IRS uses this information to assess potential conflicts of interest and ensure that nonprofit resources are used appropriately. Accessing the instructions for both forms at www.irs.gov/Form990 is vital for understanding their interconnectedness and ensuring accurate reporting.

Understanding Transactions with Interested Persons

Schedule L requires reporting details about financial arrangements with “disqualified persons” under section 4958, ensuring transparency and preventing improper benefits.

Defining “Interested Person”

Determining who qualifies as an “interested person” is crucial for accurate Schedule L reporting. This encompasses individuals wielding significant influence or having close ties to the organization. Specifically, it includes current or former directors, officers, trustees, key employees, and their family members – spouses, siblings, ancestors, and descendants.

Furthermore, any individual controlling more than 50% of the organization’s voting rights, or possessing substantial business or financial interests, also falls under this definition. The IRS focuses on identifying relationships that could potentially lead to conflicts of interest or improper private benefit.

It’s vital to consider both direct and indirect relationships when identifying interested persons. A thorough understanding of these guidelines is essential for nonprofits to comply with Form 990’s reporting requirements and avoid potential penalties. Careful documentation supporting these determinations is highly recommended.

Types of Transactions Reported on Schedule L

Schedule L requires reporting a broad spectrum of transactions involving interested persons. These include loans made to or from these individuals, covering amounts, terms, and collateral details. Beyond loans, other financial transactions like compensation, reimbursements, and payments for services must be disclosed. This extends to arrangements where the organization guarantees an obligation of an interested person.

Crucially, Schedule L also covers non-loan transfers, such as gifts, grants, or the sale of property to interested persons. Reporting isn’t limited to direct transactions; arrangements where an interested person has a significant financial interest, even indirectly, must be included.

The IRS aims to identify potential conflicts of interest and ensure organizations aren’t providing undue benefits to insiders. Accurate and complete reporting of all applicable transaction types is paramount for compliance with Form 990.

Reporting Thresholds for Transactions

Schedule L doesn’t require reporting every transaction with an interested person; specific thresholds dictate what must be disclosed. Generally, transactions exceeding $10,000 in aggregate with a single interested person during the tax year trigger reporting requirements. However, this isn’t a hard-and-fast rule.

Even transactions below $10,000 may need reporting if they are part of a pattern or series of transactions that collectively exceed the threshold. Furthermore, certain types of transactions, like excessive compensation, may require disclosure regardless of the dollar amount.

Organizations must carefully consider all transactions and arrangements to determine if they meet the reporting criteria outlined in the Form 990 instructions. Failing to report transactions meeting these thresholds can lead to penalties and scrutiny from the IRS.

Key Sections of Schedule L

Schedule L comprises three main parts: loans to/from interested persons, other financial transactions, and transfers—each demanding specific details for accurate IRS reporting.

Part I: Loans to and/or From Interested Persons

Part I of Schedule L focuses specifically on loans made to or received from individuals or entities considered “interested persons.” Organizations must meticulously detail each loan, including the borrower/lender’s name, the loan’s date, and the outstanding balance as of the filing date. Crucially, the schedule requires reporting the original loan amount, any interest rates applied, and the collateral securing the loan, if any.

Furthermore, organizations need to specify the loan’s purpose. Was it for business operations, personal use, or another reason? Accurate categorization is vital. The IRS scrutinizes these transactions to identify potential conflicts of interest or improper benefits conferred upon insiders. Complete and accurate reporting in Part I is essential for demonstrating compliance and avoiding penalties. Remember to include all loans, even those fully repaid during the tax year, if they existed at any point during the reporting period.

Part II: Other Financial Transactions with Interested Persons

Part II of Schedule L expands beyond loans, encompassing a broader range of financial transactions with “interested persons.” This includes items like sales of property, purchases of goods or services, rental agreements, and compensation arrangements. Organizations must report details for each transaction exceeding specified thresholds, providing a clear description of what was exchanged and the transaction’s value.

Similar to Part I, identifying the interested person and the transaction date is crucial. The IRS uses this information to assess whether transactions were conducted at arm’s length – meaning on fair market terms – or if they involved preferential treatment. Detailed explanations are key; simply stating “services rendered” isn’t sufficient. Specify the nature of the services and their reasonable value. Accurate reporting in Part II demonstrates responsible financial management and adherence to nonprofit regulations.

Part III: Transfers to Interested Persons (Not Loans or Financial Transactions)

Part III of Schedule L addresses transfers to interested persons that aren’t classified as loans or standard financial transactions. This covers gifts, donations, or assets given without expectation of direct financial return. Reporting requirements are triggered when these transfers exceed a certain value, demanding detailed disclosure to the IRS. Organizations must clearly identify the recipient, describe the transferred asset, and state its fair market value at the time of the transfer.

This section is vital for preventing improper benefits to insiders. The IRS scrutinizes these transfers to ensure they align with the organization’s exempt purpose and don’t constitute private inurement. Thorough documentation, including appraisal reports if applicable, is essential. Accurate completion of Part III demonstrates a commitment to transparency and responsible stewardship of nonprofit resources.

Completing Schedule L: Line-by-Line Guidance

Carefully follow IRS instructions, detailing each transaction with interested persons accurately. Precise reporting on Schedule L ensures compliance and avoids potential penalties.

Reporting Loan Details (Part I)

Part I of Schedule L (Form 990) focuses specifically on loans to and/or from interested persons. Organizations must meticulously report each loan, providing comprehensive details. This includes the borrower and lender names, the loan date, the outstanding balance as of the end of the tax year, and the interest rate applied.

Furthermore, the repayment terms – such as the loan’s maturity date and the scheduled payment amounts – must be clearly outlined. Any loan guarantees should also be disclosed. It’s crucial to differentiate between loans made to individuals and those made to entities. The IRS scrutinizes these transactions to ensure they are conducted at arm’s length and do not represent impermissible private benefit. Accurate and complete reporting in Part I is essential for demonstrating compliance and avoiding potential issues during an audit.

Detailing Other Financial Transactions (Part II)

Part II of Schedule L (Form 990) covers a broader range of financial transactions with interested persons beyond simple loans. This encompasses items like reimbursements of expenses, payments for services rendered, and other financial arrangements. Organizations must detail the type of transaction, the amount involved, and the names of the interested persons participating.

Providing a clear description of the business purpose behind each transaction is vital. The IRS wants to understand why the transaction occurred and whether it benefited the organization appropriately. Similar to loans, these transactions are evaluated for potential conflicts of interest and private inurement. Complete and accurate reporting in Part II demonstrates transparency and helps ensure the organization operates in accordance with applicable tax laws and regulations, avoiding scrutiny during an audit.

Describing Transfers (Part III)

Part III of Schedule L (Form 990) addresses transfers to interested persons that aren’t loans or typical financial transactions. This includes gifts, donations, or any asset transfer where the organization doesn’t expect equivalent value in return. Detailed reporting is crucial here, as these transfers are closely scrutinized for potential private benefit or inurement.

Organizations must specify the type of transfer, a detailed description of the asset transferred, its fair market value, and the recipient’s name. Explaining the rationale behind the transfer – its charitable purpose or organizational benefit – is essential. The IRS uses this information to assess whether the transfer aligns with the organization’s exempt purpose and doesn’t unduly benefit individuals connected to the organization. Accurate completion of Part III is vital for maintaining compliance.

IRS Resources and Where to Find Help

Visit www.irs.gov/Form990 for Schedule L (Form 990) instructions, related forms, publications, and to access the latest IRS guidance.

Accessing Form 990 Instructions and Schedule L

Organizations can readily access the complete Form 990 Instructions and Schedule L directly through the IRS website. The IRS provides downloadable PDF versions of both the form and its accompanying instructions, ensuring easy access for tax professionals and nonprofit staff alike.

These resources are typically updated annually to reflect any changes in tax law or reporting requirements. It’s crucial to utilize the most current version of the instructions when preparing Schedule L to ensure compliance. The IRS also offers a searchable database where users can find specific sections or keywords within the instructions.

Furthermore, the IRS website provides links to related publications and resources that can assist organizations in understanding their reporting obligations regarding transactions with interested persons. Regularly checking the IRS website (www.irs.gov/Form990) is recommended to stay informed about any updates or changes.

IRS Website: www.irs.gov/Form990

The IRS website, specifically www.irs.gov/Form990, serves as the central hub for all things related to Form 990 and its schedules, including Schedule L (Transactions With Interested Persons). Here, organizations can download the latest versions of the form, detailed instructions, and supplementary materials. The site offers a user-friendly interface for navigating through various tax forms and publications.

Beyond downloadable documents, the website provides frequently asked questions (FAQs) addressing common queries about Form 990 reporting. It also features links to relevant news releases and announcements from the IRS regarding updates to the form or its instructions. Utilizing this resource ensures nonprofits have access to the most current and accurate information.

The website also provides access to tools and resources designed to help organizations understand their filing requirements and avoid common errors when completing Schedule L and Form 990.

Obtaining Clarification and Assistance from the IRS

When navigating the complexities of Form 990 and Schedule L, organizations may encounter questions requiring direct clarification from the IRS. The IRS offers several avenues for assistance, including a toll-free helpline dedicated to tax inquiries. While wait times can vary, this provides a direct line to a tax professional.

Additionally, the IRS website (www.irs.gov/Form990) features a searchable knowledge base and FAQs addressing common issues related to nonprofit reporting. Organizations can also schedule appointments at local IRS Taxpayer Assistance Centers for personalized guidance.

For more complex situations, seeking professional advice from a qualified tax attorney or accountant specializing in nonprofit organizations is recommended. Remember to document all interactions with the IRS, including dates, times, and the names of representatives consulted.